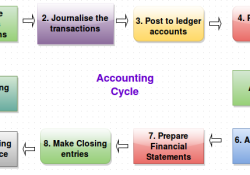

Accounting Cycle

The accounting procedure, from start to finish, follows what is called an accounting cycle. This article will give you an idea of what happens in the accounting process and reaffirm the importance of record keeping. If you are not familiar… Continue Reading